I dunno about you but when I was young, dumb (okay in fairness I was probably more naive than dumb), and broke, I would often sit there and think to myself, “Gee, is travel insurance worth it? Do I really need budget travel insurance?”

And because I had far less life experience than I do now, and infinitely less cash too, I would inevitably come to the ridiculous conclusion that nahh, travel insurance really isn’t THAT necessary.

I mean, what could possibly happen to me? I’ll just save the $200 and opt-out of travel insurance altogether since it’s a quick and easy way to save some cold, hard, cash.

Well, let me be the first one to admit that I was wrong, oh so very wrong. Because since then, I’ve learned from first-hand experience just how absolutely essential travel insurance really is. I mean, come on people. It’s on this wicked long list of travel essentials for women for a reason!

Plus, not gonna lie, I am a walking disaster of the most epic proportion. So, anything that can and will go wrong, will definitely happen to me.

Come to think of it, I’m actually kind of surprised that I haven’t fallen down a rogue well somewhere. Because without travel insurance, I’d probably have to rock out down there, impatiently waiting for none other than Lassie herself to come save me.

Maybe that’s because I’m beyond anal and actually use one of the best wheeled backpacks out there so that I don’t develop heinous beyond belief back problems.

So, if you’re still wondering, “Is travel insurance worth it”, then the short answer to that question that you’ll likely hear echoed over and over again throughout this post is yes, a thousand times yes!

Because as a full-time travel blogger, you guess it, I travel a lot. And I’ve gotten into more than one less than fun, super sticky situation where travel insurance was 110% necessary.

As a result, I know all about the incredible benefits of purchasing travel insurance and recommend that absolutely everyone and their brothers, sisters, cousins, nephews get travel insurance, or an amazing digital nomad health insurance plan, before they go anywhere, like ever.

However, if you’re still on the fence about it and are quietly wondering to yourself, “is travel t=insurance really worth the money?” then continue on my skeptical friend! Because this insanely detailed post will tell you everything you ever wanted to know about travel insurance, with detailed information on the two companies that I personally use for all my travel insurance needs.

That being said though, I do want to make it 100% clear that I am not an insurance expert and never will be. Yes I travel a lot and yes I use travel insurance all the time, but that doesn’t mean I sell insurance, know the ins and outs of every single policy out there, and can tell you exactly what is and is not covered with your plan.

Instead, I’m simply here to share my personal experiences with travel insurance so that I can help you make a more informed decision about what type of travel insurance you need for your next tri[p. I also recommend doing a bit of additional research before you purchase any insurance policy.

This way if the worst should happen (and I pray to the stars above that it doesn’t because needing travel insurance is NEVER fun), you’ll be prepared and know exactly what is and is not covered.

Because while we like to have fun here at Girl with the Passport, we also like to stay safe, be prepared, and plan for the worst so that a personal apocalypse isn’t nye since you have the best budget travel insurance with you.

PSST…This post may contain affiliate links. Please see my disclosure for more information. As an Amazon Associate, I earn a small commission from qualifying purchases.

But the Question Remains, Should I Buy Budget Travel Insurance?

Welp, in case it wasn’t already abundantly clear from my Shakespearean level awesome introduction (kidding), yes, yes you should.

And no, there is never a good reason to go without travel insurance. Unless of course, you’re already covered. But don’t worry, we’ll talk more about that ultra-mundane and slightly boring topic later on in this post.

However, that being said, the whole purchasing insurance thing can be a bit confusing (understatement of the century). And since my non-psychic powers are telling me that you’re thinking about buying insurance (yeah, sorry but the title of this post kind of gave your real intentions away), then you probably have about a million and one questions about what policy to get, what your policy will likely cover, and so on and so forth.

Slow your roll for just a minute though. I mean, I know talking about travel insurance is uber-exciting. But, before we just dive right into all this travel insurance related goodness, let’s first discuss what will happen if you do the slightly irresponsible thing, take a chance, and decide not to get travel insurance.

Dun, dun, dun…

But Why Should I Buy Budget Travel Insurance?

Instead of me droning on about a list of facts and figures that detail the importance of travel insurance, let me spin you a fun little yarn instead. A tale that will share the very real physical and financial consequences of NOT having travel insurance.

Okay, so you’ve decided to flip the bird at modern-day conventions like travel insurance and are gonna go it alone.

Good for you. Way to be your own person. I personally wouldn’t do that since I’ve been victimized by bad luck more times than I can count. But, for better or worse, you have the gift of free will and it’s totally your call. I mean, you’re a grown adult human.

However, if you do forego travel insurance altogether, run into a bit of bad luck, and get nibbled on by a hungry yeti, what exactly will happen?

Okay, I’m obviously joking about the Yeti. But on a more serious note, let’s say you’re going full-on, Travelocity roaming gnome and hitting up super cool places like Singapore, Bali, Vietnam, and Thailand.

You’re taking all the proper safety precautions and are basically like every parent’s dream traveler since you don’t do drugs, don’t drink, are home in bed before 8:00 pm every night, and even included a nifty little first aid kit in your fly AF carry on bag.

Then, without warning, something horrible happens. A guy steals your wallet, you get bitten by a stray dog, you break your leg in a motorbike accident, you contract Dengue Fever from a mosquito bite, etc.

And FYI, just in case you think all of these ill-fated travel scenarios are totally unlikely, they have all happened to either me or someone I know. So yes, bad things really can happen to you, even when you’re living your best life on vacation.

Now, let’s say you don’t have travel insurance but you have something totally run of the mill happen (lucky you) like a UTI. Yeah, it’s not insanely serious but it’s uncomfortable and something that you kind of need to deal with. I mean, if you let it go, you could get a kidney infection, go septic, and end up receiving intravenous drugs in the hospital for a solid week.

And yes, you guessed it. This really DID happen to me. It was also a week before I was supposed to leave on a cruise through the Mediterranean with my mother. And spoiler alert? We did not have travel insurance, could not go on our trip, and lost a butt ton of money.

But, you’re infinitely luckier then we were and actually got to go on your trip. However, unluckily enough, you think you have a UTI, it’s 9:00 pm on a weeknight, and your flight leaves tomorrow. Frantically, you race down to the front desk of your hotel so that they can call you a taxi and have the driver take you to the nearest hospital.

It looks a bit dodgy but you wait three hours and finally get seen by the doctor, who prescribes you a run of the mill antibiotic Which would be fine except that the pharmacy has already closed for the evening and you definitely can’t board your flight tomorrow without your meds. And since your flight leaves early tomorrow morning, it looks like you’re gonna have to miss your flight and book another one.

So, awesome. You now have to book a hotel room, pay for the doctor’s visit, pay for the medication, and pay for a new flight back home. Because yeah, you totally have thousands upon thousands of dollars in cash just collecting dust in your bank account.

I mean, clearly you’re so wealthy that you chose to save $200 on your trip by not getting travel insurance and can easily afford all these excess expenses. I mean, that’s what a credit card is for, am I right?

And while credit cards are awesome, going into thousands of dollars of debt because you opted out of travel insurance is not.

Because while we all like to think that nothing bad will happen to us on vacation, the sometimes not-so-fun truth is that something bad can and often does happen.

I mean, travel often enough and something will definitely go wrong. And, added bonus? It usually happens when you least expect it.

So, if you don’t have travel insurance, you won’t have a third party to help you out. Instead, you’ll be left totally dazed and confused and devoid of a whole lot of cash.

And this is all assuming, of course, that you’ve run into a relatively benign problem that isn’t life-threatening. Because just think of how much it would cost you and your family if you needed to be airlifted from Everest Base Camp to a hospital in Katmandu (You guessed it. This really did happen. My friend went on a trek to Everest Base Camp and during the hike, a woman got severe altitude sickness, turned blue, went into cardiac arrest, and had to be rushed out via helicopter).

So, moral of the story? Don’t get caught without travel insurance and get it for every single trip you go on every single time. Trust me on this. It’s one of those things I never skimp on because the consequences could be quite literally life-changing.

Especially since well, if you have enough money to travel then you have more than enough money to buy a great backpacker travel insurance policy.

But Wait, Could I have Travel Insurance and Not Even Know It?

While admittedly slim, there is a small chance that you might already have travel insurance and not even know it. And some of the most common sources of travel insurance, short of actually outright buying it, include:

- Health Insurance – Believe it or not, some ultra-snazzy healthcare providers might actually cover medical expenses that you incur while traveling. I mean, that has never been my personal experience since I’m just not that lucky (I can barely get them to cover me at home, let alone abroad). But hey, you never know, it could happen!

- Tour Providers – If you book a travel package through a tour company or a travel agent, then you may be able to get a discounted travel insurance policy as part of your vacation package. However, that doesn’t guarantee that the policy on offer is actually the right fit for you. Because yeah, it’s fairly common for tour providers to give you either not enough or way too much insurance coverage. And since the insurance is part of a larger travel package, it can be difficult to customize. So, do your research and always make sure to get a plan that is best for you.

- Credit Cards – If you have a credit card that is designed for frequent travelers like the Chase Saphire Preferred card I have right here in my wallet, then there’s a good chance that you can enjoy some of their awesome insurance benefits, like protection against trip cancelation or interruption. So, if you paid for your trip with a card like this, then any travel-related issues that might arise will probably be covered by your credit card of awesome. FYI though, these types of cards usually do NOT cover medical-related expenses. So yeah, you’ve been warned.

- Renter’s/Homeowner’s Insurance – Yeah, I know exactly nothing about this since I neither rent an apartment nor own a home. Yup, digital nomad life for the win. But, I have heard through the grapevine that these types of policies may cover the loss of any personal belongings while you’re on the road. Apparently, there’s some rando clause called “off-premise protection” that basically protects all of your belongings even when you’re not at home. But I know next to nothing about this kind of stuff so always check with your policy first and don’t make any assumptions.

All that being said, you need to remember that I am an anxiety-riddled, panic attack prone traveler who absolutely MUST buy travel insurance before going on any domestic or international trip.

A tendency that might be a bit overkill since your health insurance will likely cover any of your medical problems domestically while your travel-related credit card will usually cover any trip-related mishaps of doom while in your home country (or elsewhere for that matter). But whatever, I’d rather be safe than sorry.

And just in case you were wondering, yes, I always purchase travel insurance before ever leaving the good old US of A. You also may want to contact the embassy that issued you your passport so you can get a list of local medical facilities that you can hit up if anything bad should happen (Medically speaking that is. Don’t call them up if you get into a fight with your bf),

Additionally, for the price of a small donation, you can use the International Association for Medical Assistance to search for English-speaking doctors wherever it is that you’re going. You know, just to be anal-retentive and extra safe like me.

What Will Budget Travel Insurance Cover?

Yes, not the sexiest part of this post, which endeavors to answer the immortal Google query, “Is travel insurance worth it?”

But, essential none the less since some of the travel insurance policies out there are straight-up unintelligible with their uber-confusing jargon.

However, most of the policies that you’ll come across should cover the following:

- Death – Yeah, let’s get the super icky one out of the way first. Because absolutely no one wants to think about dying while shaking their bonbon and livin’ la vida loca while on vacay (Also, did you love that Ricky Martin reference there? Because I definitely did). But travel insurance should definitely get your remains back to your loved ones if the worst should happen. And at no cost to them mind you.

- Medical Coverage (often including dental) – While most policies have a cap (usually they’ll cover between $50,000 and $100,000 worth of medical bills), they will typically cover any emergency medical expenses that you incur while traveling. So, if you get sick or injured in another country, your insurance should cover all of your doctor’s visits, medications, hospitalizations, etc. Heck, they’ll even throw in an emergency helicopter evacuation or two just in case something really bad happens.

- Evacuation – This often falls within your medical coverage but this part of your budget travel insurance policy will cover the expense of emergency medical evacuation to the nearest appropriate care facility – something that is incredibly important if you’re going to a remote destination and won’t be near any major medical facilities.

- Baggage– If your bags are lost, stolen, or delayed, your policy will cover the cost of replacing your bag and the loss of all the goodies that you had inside. However, per usual, most companies are pretty stingy and will only give you a fairly minimal amount of money for your belongings. So if you can, always try to keep anything super valuable on your person at all times. But, any halfway decent policy should reimburse you for any clothes, medication, and other essential items if your luggage is delayed or lost when arriving to its final destination.

- Vacation Cancellation and Interruption – If you need to abruptly cancel your trip or must change your plans due to an emergency (and an emergency can be classified as something like a death, natural disaster, sudden illness, civil war, etc.), your insurance will refund you for any non-refundable purchases that you made.

- Lost or Stolen Belongings – This one is pretty self-explanatory. But, if your shiz gets damaged, lost, or stolen while you’re away from home, insurance should cover it. However, coverage is typically fairly small, at least in terms of monetary value. So, if you decide that you need to bring your brand spanking’ new, $10,000 drone on vacation with you, you’ll 100% need a special insurance policy for that.

- Inclement Weather – If your trip gets canceled or delayed because of a typhoon or a killer tsunami, no worries. Travel insurance will cover that.

- Flights – Many travel insurance companies offer coverage solely for difficulties that you might encounter with your flights. So you may be able to purchase a plan just to cover your flight or for your entire trip. This type of insurance will reimburse you for any fees incurred in the event of a delay or cancellation because of bad weather, mechanical breakdowns, or labor strikes.

- The Financial Ruin of Any Institution You’ve Made Travel Plans with – That was needlessly dramatic but if you book a hotel, flight cruise, or tour with any company that suddenly goes bankrupt, your financial losses should be covered by good old reliable, travel insurance.

However, as usual, always carefully read any insurance policy before you buy it. This way. you know exactly what is and is not covered as you kick ass, take names, and travel the world.

And FYI, only literally do the last part.

What Won’t Budget Travel Insurance Cover?

So, although I am extolling the incredible virtues of travel insurance and do suggest that you get it for every single trip…EVER, travel insurance isn’t exactly some sort of glitter-encrusted, life panacea.

As a result, there are a ton of things that travel will NOT cover, like general stupidity or poor travel planning. However, does that really surprise you? I mean, these are for-profit companies who actually want to make gobs of money all day, every day. And they won’t exactly get to do that if they have to pay you off every time you decide to go cow tipping in Laos and get caught in a stampede.

That’s why here’s a brief list of all the things that most insurance policies will NOT cover.

- General Stupidity – I could use a more PC term but why? Because the truth is, if you do something dumb and ridiculously stupid, travel insurance will not cover you. So yeah, if you decide to climb Mount Everest in shorts and a t-shirt or attempt to balance on the handles of your new moped, travel insurance ain’t got time for that and will be giving you exactly no dollar bills.

- Pre-existing Conditions – If you’re sick prior to the start of your trip (like have been treated within the past two years for something) and that condition flares up (and there’s proof that you knew about it from a previous doctor’s visit or a prescription) while you’re away from home, then you will not be covered. Conversely, if there’s a civil war that started before you booked your trip to a politically unstable country, you will not be reimbursed for canceling your trip when you suddenly realize it was a huge mistake to travel to a war-torn country. More likely though, it’ll be something minor like a strike or a riot that started before your trip. And even if you didn’t actually know about it, if it started before your trip began and you need to cancel your plans, you have no way to prove that you didn’t know about it and will likely not get reimbursed.

- Routine Medical Check-Ups – Yeah, sorry but travel insurance only covers emergencies and not preventative care. So, don’t go on vacay, schedule 15 years’ worth of medical check-ups, and expect travel insurance to foot the bill because they won’t.

- War and or Acts of Terrorism – And you thought my insane reference to a civil war was totally irrelevant. But yeah, if this crazy AF year has proved anything, it’s that anything can and will happen. So, if you’re planning to travel to a place that is known for having its fair share of civil unrest, then double-check your policy and make sure it covers either an act of war or terrorism because a lot of policies don’t. And even if you can get coverage for this type of event, the aforementioned incidence needs to have started AFTER you bought your insurance. So, if it’s a long term conflict that you already knew about, you will again, NOT be covered.

- Fear that Something Bad Might Happen – If you want to cancel your trip because you think that something bad might happen, your insurance will not cover you. Unless of course something bad really did happen and neither you nor anyone else had any idea about it prior to the start of your trip.

- Expensive Travel Gear – While most policies will cover damage/loss of travel gear, the limit for the payout on this type of claim is usually quite low. Therefore, if you decide to travel with your laptop, drone, video camera, or anything else super expensive, you effectively won’t be covered for loss or damage to these items since the financial compensation you’ll receive will not match the price of these items. So, definitely purchase a supplementary policy for this type of equipment if you’re planning on being a total baller and traveling with this type of gear.

- Alien Abduction – Kidding…or am I? Nahh, I just wanted to see if you were still paying attention.

When Should I Get Travel Insurance?

Oh look, a question with a relatively straight forward answer that won’t take me 10,000 words to explain.

So yeah, pretty much the best time to buy travel insurance is within 15 days of making the first deposit on your upcoming trip.

Because believe it or not, buying travel insurance early can actually qualify you for bonus coverage. This does vary by plan though so always do your research.

And if you’re perpetually last-minute Lucy like me, then not to worry because most plans will allow you to buy coverage up until the day before you leave (World Nomads, who I’ll mention later, will actually let you add/change your coverage while still on vacation. Yup, they’re pretty rad with a capital “R”.).

What to Know Before Purchasing Budget Travel Insurance

Because we live in a crazy world and at a crazy time in history, here is a list of things that you might not know about travel insurance and that you’ll want to do before getting budget travel insurance.

A fun little checklist of things you should do so that you’ll be able to pick the perfect budget travel insurance plan for you.

- Read the Entire Policy Before Buying it and Make Sure it Covers the Activities You’ll Be Doing – Look, most insurance policies won’t cover insanely dangerous hobbies like cage diving with Great White Sharks or riding your motorcycle over the Grand Canyon. And that makes sense since the likelihood of doing yourself bodily harm during either one of these activities is pretty dang high. However, things can quickly get murky since everyone has a different idea about what is excessively adventurous and dangerous travel. So, definitely do your research and know exactly what type of “dangerous activities” are and are not covered by your policy. I mean, I personally don’t consider white water rafting to be all that life-threatening, but some policies I’ve encountered just won’t cover me if I get hurt doing this wicked awesome activity. So yeah, definitely know before you go. And thankfully, both SafetyWing and World Nomads make it incredibly easy to figure out exactly what is and is not covered since they’re pretty explicit on their respective websites and list out the broad range of activities they cover.

- Know that Global Pandemics May Not Be Covered – Prior to 2020, I’m sure I’m not the only one who thought that the idea of a great plague sweeping across the planet and totally shutting down the entire world was a bit far fetched. But, surprise, it’s not! That’s why you need to double-check your policy and see if canceled travel plans as the result of pandemic (or localized endemic) are actually covered. Because sometimes these type of “freak”, worldwide events are the exception to the rule and will not be covered by insurance. So, the best way to protect yourself is do a ton of research and always know exactly what will and will not be covered. You’ll also save yourself the hassle of trying to file a claim and getting all the relevant paperwork together, only to find out that your situation is actually not covered by insurance. Yup, been there, done that, and it is very un-fun indeed.

- Compare Insurance Prices Online – To make sure you’re getting the best possible coverage for the least amount of money, use sites like InsureMyTrip to quickly generate budget travel insurance quotes from a variety of different companies based on your travel destination, trip duration, travelers’ ages, country of residence, and the overall cost of your trip. This way, you can quickly and easily assess how much insurance policies will cost from different companies and choose the cheapest/best policy for you.

- Talk to Others – Read online reviews, pursue through travel forums, ask questions in Facebook groups, and see what other travelers are actually saying about the budget travel insurance that you want to buy.

- Purchase Budget Travel Insurance as Soon as You Book Your Trip – The sooner the better when it comes to booking travel insurance because prices tend to go up the closure you are to your departure date.

- Always Print Out Copies of and Create Digitial Versions of Your Insurance – Save hard copies and digital copies of ALL your important travel-related documents, including your travel insurance. This way, if something does happen and you lose all of your belongings, you still have proof of your insurance and have all the documentation needed to file a claim. Also, keep the number of your insurance policy handy so that you can easily find it if you do need to make a claim.

How Much Does Budget Travel Insurance Cost?

It obviously depends on the policy you get since every travel insurance company is different

But as a general rule, you should expect to pay anywhere between 4% and 10% of the total pre-paid cost of your trip.

So, let’s say you spent $5,000 on an upcoming trip. Well then, most insurance companies will charge you somewhere in the neighborhood of between $250 and $500, depending on nifty little variables like where you’re from, where you’re traveling, your age, the size of your family, etc.

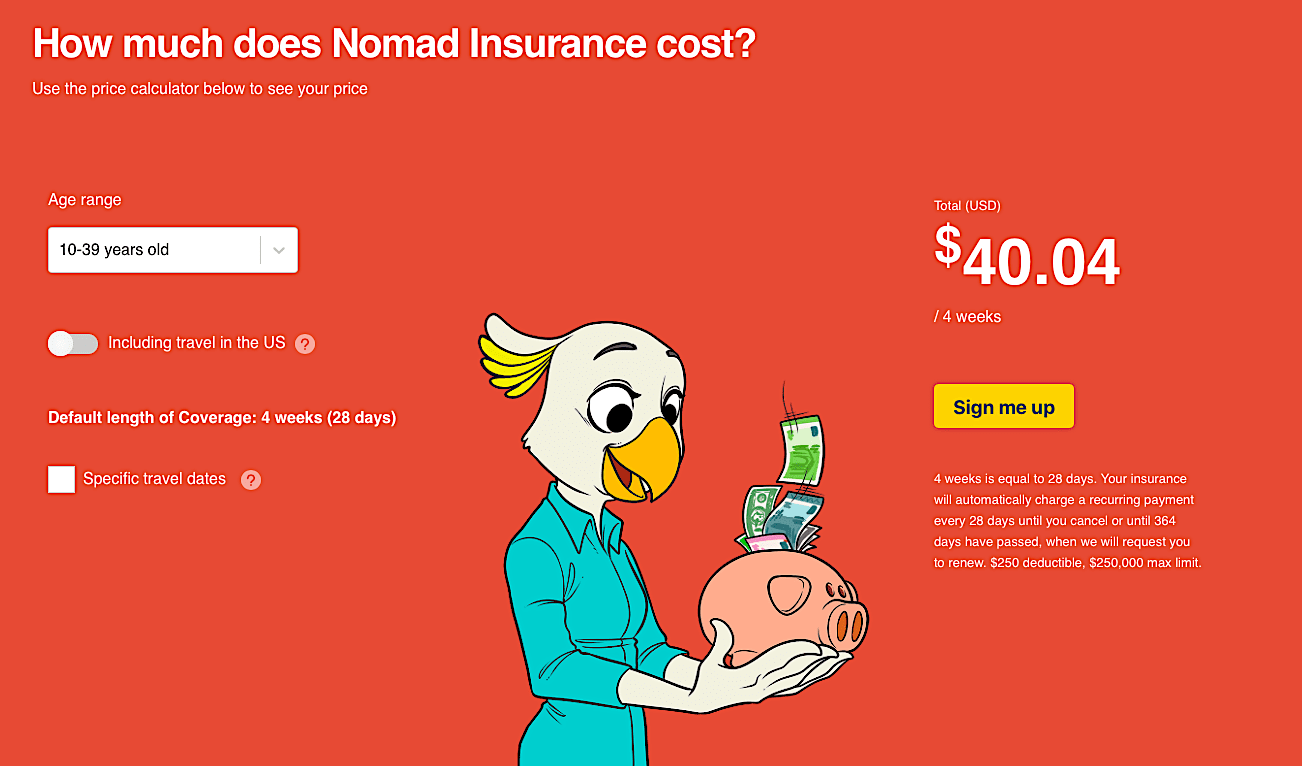

Personally though, as you will soon find out below, I pay $40.04 per month for SafetyWing since I am between 10 and 39 years old.

With this policy (the duration of which is a minimum of five days and a maximum 364 days), I have an automatic, recurring payment every 28 days with a $250 deductible and $250,000 max limit.

And I’m not gonna lie, this is SUPER cheap when it comes to insurance. That’s why I always opt for SafetyWing when I’m doing long term travel.

Yeah, I just can’t afford to use World Nomads long term, although they are quite good and are the other travel insurance company that I would personally recommend,

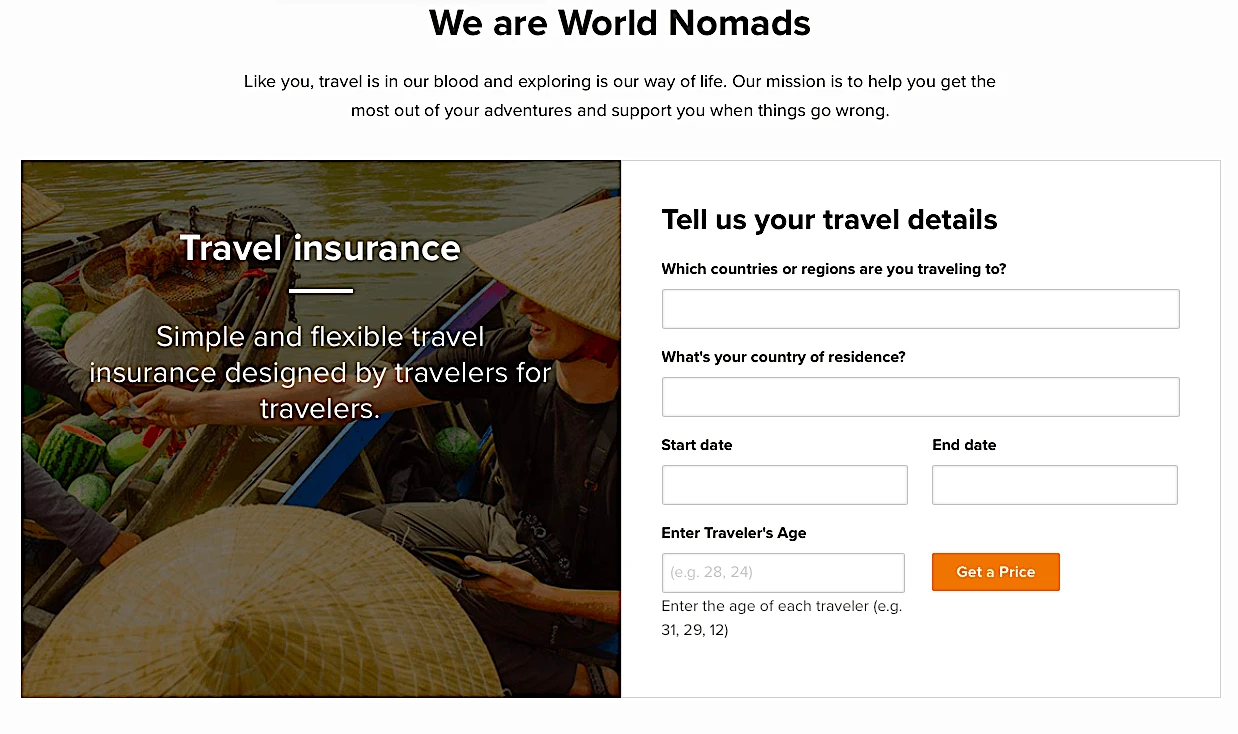

I’ve used them a bunch and typically pay in the neighborhood of between $70 and $150 for a policy. However, you may pay something completely different since the price of their policies really depends on a variety of different factors like:

- Where you’re traveling

- Your country of residence

- Length of trip

- Traveler’s age

- The policy you choose – They have a Standard plan and an Explorer plan. The second is more expensive since it covers a broader range of activities.

However, I literally just went on their website and researched the cost of travel insurance for a pretend, two-week European vacay I’m taking, and it would cost me $77.78 for a base policy and $140.66 for an Explorer Plan. So yeah, now you know.

So, Drumroll Please, What is the Best Budget Travel Insurance Out There?

Okay, full disclosure? Although I have used a bunch of different travel insurance companies, I definitely haven’t worked with all of them. So, there could be some really good insurance providers out there that I just legit do not know anything about.

Therefore, while I do personally recommend, know, love, and use both World Nomads and Safety Wing, feel free to go with the best insurance company for YOU and make sure that their policies fit YOUR specific needs – which could be very different from my own.

Some things to look for though in a policy include:

- Make sure they cover unexpected medical expenses while traveling, lost/stolen/damaged luggage, emergency trip cancelation or interruption, and emergency medical evacuation. If a policy doesn’t cover this type of stuff then do not buy it.

- Know how much the policy costs and make sure there are no hidden fees. And you shouldn’t have to go on a scavenger hunt to find this info either. It should be readily available right on their website.

- Make sure they have information that you can actually understand on what is and is not covered by your policy. Because while overly technical jargon may be beneficial in protecting them, it doesn’t really help you understand what the company might actually pay you for.

- Always read reviews and ask other travelers about their personal experiences with a company. I find people are only too happy to share their experiences with a company when they have been less than stellar. That being said, no company is perfect. So, look for general trends and see which companies, on the whole, seem to be satisfying customers and quickly handling claims.

And now for my personal picks for the best travel insurance plans for travelers. I’ve used both and I typically use World Nomads for short-term, adventurous, international travel and SafetyWing for longer trips since they provide good coverage and are way cheaper on a monthly basis than World Nomads.

So, let’s look at each one in detail to see exactly which provider might be a good fit for you.

1. Safety Wing

I love Saftey Wing, think they provide awesome coverage, and have been using them for years. Hence the reason why, DUH, I first recommended them in my post about all of the top travel essentials for women.

Sure, World Nomads is great, but if you’re traveling the world long term, as a not-so-fancy digital nomad like me, and you just can’t afford to pay for World Nomads travel insurance EVERY SINGLE MONTH, then SafetyWing is here to help!

Because just like many other travel insurance companies out there, purchasing a policy from this amazing company means that you’ll be covered if you develop an unexpected illness or injury while you travel.

As a result, all eligible hospital, doctor, and prescription drugs expenses will be covered if you happen to get ill, or injured, while you’re traveling (for a list of exclusions, please refer to their Description of Coverage).

Additionally, SafetyWing also offers you comprehensive protection against various emergency, travel-related events like emergency medical evacuation, bedside visits, travel delay, lost checked luggage, trip interruption, political evacuation, personal liability, and more!

Pretty sweet right? But, “Why SafetyWing?”, I hear you rightfully wondering?

Well: one of the most amazing things about Safetywing is that it was created by digital nomads, FOR digital nomads. Therefore, policies purchased through this company are not only inexpensive (Policies can cost as little as $37 per month for travelers age 18-39) and comprehensive, but SafetyWing also has an ongoing, automatic, monthly subscription service that makes it incredibly easy for you to maintain your insurance policy while you’re long-term traveling.

So, all you need to do is sign up once, and the company will automatically re-enroll you until you choose to discontinue your policy, or until you’ve had your policy in effect for a full calendar year

And that’s just some of what SafetyWing offers (Check out their full policy to understand exactly what is and is not covered). Because purchasing a policy with SafetyWing just got even better!

Because not only will you enjoy coverage in almost any country that you might want to travel to (outside of super offbeat destinations like Iran, North Korea, and Cuba), but you’ll also receive $250,000 worth of coverage (There is also one low, annual, overall deductible of $250), and can even use private health care providers in countries where the public healthcare system might be, eh, not so hot.

However, with all that said, SafetyWing does have its limitations and will only cover some, non-medical problems that you encounter while traveling. Therefore, things like trip cancellation and stolen travel gear are NOT covered with their policy.

Also, if you’re over the age of 69, you will NOT be able to purchase a policy with them. And if you decide to visit the US, you will actually have to cancel your current plan and buy an entirely new plan since their basic plan does not offer US insurance (US residents also cannot purchase insurance for the US).

But trust me, purchasing a new, SafetyWing plan that includes health insurance for the US is incredibly easy to do (FYI: Travel to the US adds $31 to the cost of your policy for every month that you use it).

So, the only question that remains is, “What are you waiting for?” Because this policy is perfect for long-term nomads and ex-pats alike. So much so that you don’t even need a permanent home address or predetermined list of travel destinations to sign up.

They also have two different plans for you to choose from, one of which is brand-spankin’ new and was not actually not even available when I first started using them.

- Remote Health – Designed with full-time travelers in mind, this plan costs between $80 and $160 per month, It also features fully comprehensive international travel health insurance that will cover everything from cancer treatment to birth control. So, think of it as a more traditional form of health insurance that also covers emergency medical situations while you travel. You also have the option of upgrading your plan and including various add ons like dental, $0 deductibles, outpatient treatment (medical care provided outside the hospital), maternity, and screenings/vaccines (routine health checks). You’ll also get worldwide coverage except in the US, Hong Kong, and Singapore since you need to purchase an add on to get coverage in these counties. This plan also excludes Americans living in the USA and Canadians living in Canada.

- Basic Nomad Insurance Plan – This plan provides frequent travelers and digital nomads with travel insurance and emergency medical coverage while they’re traveling – making it the perfect supplement to the insurance policy that you have in your country of permanent residence. Coverage options can range anywhere between five days and one year but do not include trips to North Korea, Iran, and Cuba, . Visits to your home country are also partially covered since you can use this option every 90 days if you want to spend a limited amount of time in your country of origin. And by a limited amount of time I mean 30 days or less, and 15 days or less for US residents. A lot of adventure-related activities are also covered by the policy as are young children (FYI, you can include up to two children under the age of ten per family). You can even purchase your plan on the road and again, don’t need any definite travel plans.

So, what are you waiting for? Go forth, and purchase SafetyWing health insurance, at least if you want no-hassle, low-cost, comprehensive medical coverage that will always be there for you, just in case the very worst should happen (Hopefully nothing bad happens, but it’s always good to be prepared!)

2. World Nomads

Personally, I use World Nomads for short, international trips where I might be living a bit dangerously and doing something moderately wild, like white water rafting,

I mean not only is it incredibly easy to book a policy online (they literally do it for you in seconds), but World Nomads travel insurance covers pretty much any destination you might want to visit (besides SUPER offbeat places like Pakistan), gives you an awesome level of coverage that includes any travel disaster possible (short of being impaled by a rogue a Narwhal), features super customizable plans, and even allows you to extend/change your travel insurance policy while you’re on the road.

Amazing right? However, one question remains, What plan should you go with?

Well, thankfully, World Nomads makes budget travel insurance really easy! So, if all of your travel gear is worth less than $1000, get the basic plan.

However, If you’re a not-so-fancy travel blogger like me who brings a camera, laptop, tablet, and phone with you on every trip – gear that EASILY costs over a $1000 – then the explorer plan is the way to go since you’ll get a higher level of coverage for your belongings and still receive emergency medical coverage of up to $100,000 (both plans feature up to $100,000 worth of medical coverage).

Additionally, World Nomads also offers:

- Comprehensive medical and dental coverage (Yes kids! We finally have dental!)

- Covers a wide ridge of adventurous activities that many other policies do not (The Explorer Plan is really awesome for this and even covers things like bungee jumping and sky diving. FYI though, the Explorer Plan does cover a much more robust array of adventure-related activities than the basic plan)

- Covers you in your home country as long as you’re at least 100 miles away from home

- Covers Non-Medical Evacuation – If there’s a natural disaster, political unrest, or any other non-medical reason for you to flee your travel destination, World Nomads will help pay to get you home.

- 24/7 Emergency Assistance – Thankfully, I’ve never had to use this feature myself. But, it’s nice to know that there’s someone on the other end of the phone that you can call. You know, just in case your entire vacation /spontaneously combusts and becomes a total disaster.

That being said though, as a result of the recent pandemic of doom, World Nomads is currently is only selling budget travel insurance to American residents, circa April 2020.

So, if you’re one of my distinctly non-American brethren, then you’re sadly out of luck and should definitely opt with SafetyWing instead.

Otherwise, get a quote today! Because if you travel relatively infrequently, are looking for amazing backpacker travel insurance that covers a wide array of adventurous activities, and want fantastic 24/7 customer support, then World Nomads is totally where it’s at.

How to File a Budget Travel Insurance Claim

Okay, let’s fast forward a little bit, You’ve finally picked out the perfect backpacker travel insurance for YOU/

HOORAY!

But now, guess what? The worst has actually happened and you need to file a claim (boo). So, er, um, how on Earth do you do that? How do you actually use your budget travel insurance to get reimbursed and collect all those Benjamins?

Welp, that’s what this handy dandy little section is for. It will tell you everything you need to know about actually filing a budget travel insurance claim.

- File Your Claim Immediately – Nine times out of ten, any claim that you file is an inconvenience and not necessarily a stage ten, post-apocalyptic level melt-down. And because no one enjoys the hassle of filing an insurance claim, we tend to put it off and wait a while before we file a claim. Something that can be a big mistake since most policies give you 90 days from the date of your loss to file your claim. Wait any longer and your claim will probably get denied. So, be sure to check your specific policy, see how long you have to file a claim and make sure to do so within the allotted time frame.

- Document EVERYTHING – Look, insurance company’s don’t have gobs of money because they just give it all away to anyone who says they had flight dealy. Nope, they require you to have proper documentation of any and all claims that you file. So, this means that you’ll need to thoroughly document (in the form of receipts) all of your trip costs, your reasons for delay/trip cancelation (this could be a note from a doctor or a police report if something has been stolen or a note from the airline if your flight was delayed), and any refunds that you might receive. Trust me, I know this may seem insane but insurance companies need proof before they can give you any money. So, some documents you might want to keep on file before you leave on vacation include:

- Receipts/Bills for all expenses

- Documentation of any refunds or expense allowances you received.

- Confirmation of your hotel stay

- Documentation to show why you HAD to cancel your trip

- Proof of diagnosis or medical injury

- Receipts from any medical treatment

- Receipts for flights, tours, hotels, transportation, and any other money you spent on your trip since the insurance company will only reimburse you for things you can prove you spent money on.

- Police Report (if something gets stolen, file a police report so you have proof it happened)

- A letter from a tour operator or an itemized bill from a travel agent stating what parts of the trip are non-refundable.

- Etc. So basically, document EVERYTHING. And that is not an exaggeration.

- Immediately Contact Your Insurance Provider – Policies sometimes have weird stipulations about where you can go for medical treatment. So, it’s always a good idea to have your insurance provider’s emergency number handy. This way, you can ask them where to go and what to do so that you have documented proof of whatever horrible thing is happening to you. And FYI, whoever you are talking to on the phone probably does this for a living and will know exactly how to calm you down. They will also be able to help you ascertain the best course of action to take since you’re probably pretty upset and in a state of shock.

- Don’t Exaggerate Your Losses – I know it may be tempting to try and get as much money out of your insurance company as humanly possible. I mean, they’re rich and you paid for your budget travel insurance. So, why not say that you had a seizure as opposed to a migraine headache so that you can get a bit little extra money? Umm because that’s insurance fraud and it’s against the law. So yeah, if you intentionally misrepresent your claim in any way, your claim could get flat out denied, even if you really do have a partially valid claim. That’s why you should always stick with the facts and try not to exaggerate in any way.

- Check Your Plan Limits – Depending on the specific budget travel insurance plan you choose, there will be a specific coverage limit for every aspect of the plan. Or, a maximum amount of money that the insurance company will pay you for whatever bad thing has happened to you. So, let’s say you lost your luggage which was worth $10,000. But, if your plan only includes a $1,000 worth of lost/stolen baggage benefits, then you’ll only get $1,000 to cover your losses. So, know these limits and get extra coverage if you think you’ll need it (You know, for that expensive AF drone you just bought). And yes, you will need original receipts to get reimbursed for and prove the exact value of anything that you’ve lost/damaged during your trip.

- Don’t Be Surprised If You Need to Pay for Everything Up Front – Yeah, this definitely sucks but that’s just the way it is. Sure, your insurance company may advance you money in certain instances. But in general, you pay for the emergency and your provider insurance will reimburse you once you file a claim and provide them with the proper documentation. And yes, it really could take months for you to get your money back. Which is why it’s always good to travel with a credit card that has a high spending limit. You know, just in case of a serious emergency. And no, I’m referring to a shopping emergency. No really, I’m not. LOL.

Welp cool kids, who are looking for awesome budget travel insurance, I hope I’ve somehow managed to make this dull as dishwater topic mildly interesting.

I also hope that this guide to backpacker travel insurance has been more than a little useful and has shown you exactly why you need travel insurance and where you can get it.

Holidays from Hels

Saturday 3rd of October 2020

Thank you for the really comprehensive post. I always buy an annual family policy - usually at least silver as this works out as a good balance between cost and cover. Covid has been a bit of a night mare. I bought my 15 month policy in June to cover 2 summers and knew that basic cover was provided for Covid but not a lot. Most insurers, including my own, now seem to be adding it for free for existing policies so I'm feeling a bit happier about next summer's trip to the US from the UK. Although I'm still not sure if they cover the situation where you do not have Covid but have been told to isolate by school/track and trace. I'd be interested to know if you have found any policies which cover this?

girlwiththepassport

Monday 5th of October 2020

Yeah. It's difficult because it varies by policy and by where you are in the world. My best advice would be to do thorough research on each policy and ask exactly what they do and do nto cover with regards to coverage. I currently use Safetywing and I know some high-risk areas are not covered with regards to COVID. Good luck!

Cosette

Saturday 3rd of October 2020

We have a annualy travel insurance, and have had to use it a few times. Next to that we also have a cancellation insurance, which we've also had to use a few times.

A Capone Connection

Saturday 3rd of October 2020

This is SUPER helpful! I never was big on travel insurance before but I definitely will be using it in the future after what we have seen happen with COVID. Thank you so much for sharing all of this information.

girlwiththepassport

Monday 5th of October 2020

Happy to help and so glad you found this useful!